The 100 cc motorcycle is a segment where Hero MotoCorp has been the monarch for many years now. Its former ally, Honda, has tried hard to make a dent in this 100 cc motorcycle space along with other local players like TVS Motor and Bajaj Auto in the past but none has been successful.

Now, with the launch of the Shine 100, this is Honda’s biggest attempt to dislodge Hero from its pedestal and it remains to be seen if it can achieve this objective. It is crucial for the Japanese two wheeler maker Honda since this could even help it tilt the leadership scales in its favour after years of waiting since the two called it quits to their long partnership in 2010.

India's 100 cc motorcycle market has seen a host of brands like the iconic Yamaha RX 100, Hero Honda CD 100, Suzuki Samurai, LML Freedom, Mahindra Centuro, Bajaj Discover, CT 100, TVS Centra and Star City etc. Many have exited the space simply because they could not make a dent in Hero’s armour and this has been frustrating for them because this is the largest selling category in the country. What makes the space more interesting is the last year's episode when Honda had briefly overtaken Hero in end-consumer registrations.

Hero Splendor has ruled the roost for many years now and was first introduced in 1994 as a successor to the popular CD 100. Three decades have passed and motorcycle experts believe the first true challenger has come in the form of Shine 100 which could stir up in the market.

Changing Preferences

Anuj Sethi, Senior Director, CRISIL Ratings believes global brands like Honda and Yamaha initially focused on higher capacity motorcycles and scooters where they gained market share.

“These vehicles are also preferred more in urban cities and semi-urban towns,” he told Mobility Outlook.

Subhabrata Sengupta, Executive Director, Avalon Consulting, feels customers are moving away from this segment to higher power motorcycles that fall in the same price range as 100 cc and 110 cc options.

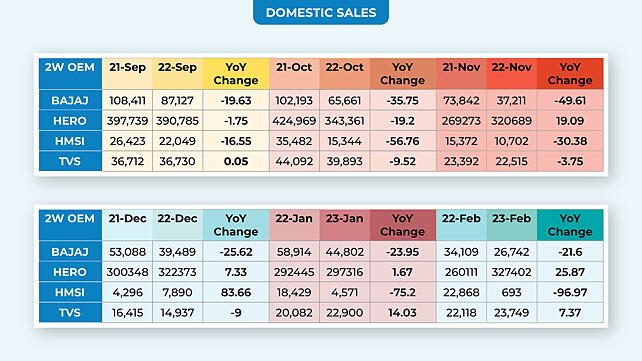

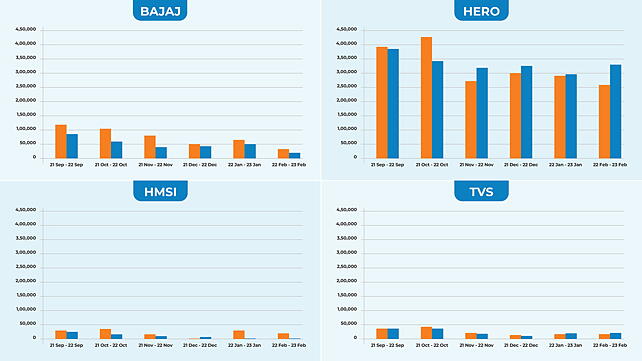

Honda Motorcycle & Scooter India (HMSI) sold barely 693 motorcycles (up to 110 cc) in February 2023 against 22,868 units in the same month last year. Its sales in this category have been falling year-on-Year, going by SIAM data, which also show that against 18,429 motorcycles sold in January 2022, it could only retail 4,571 units in the same month this year.

In the case of a local player like Bajaj Auto, sales fell to 26,742 motorcycles in February 2023 from 34,100 units in the same months last year. During the last six months, Bajaj's highest domestic sales in the 100 cc category was in September 2022 at 87,127 units which was still lower than 102,193 units in September ’21.

TVS Motor has registered growth in the segment but is still a long way from Hero. The demand for entry-level two-wheelers (2W), which primarily caters to rural and semi-urban markets, has been falling for the past two fiscals across scooters (up to 90cc) and motorcycles with engine capacities up to 110cc as well as mopeds of up to 100cc.

Weak Rural Sentiment

Sethi said the “slow recovery in rural demand” has been a key reason for this fall. “Weak rural income sentiments, postponement of purchases due to rising petrol prices and multiple price hikes, following increased input prices and costs incurred to comply with safety norms and BS-VI norms, have caused this,” he elaborated. Beyond this, has been the shift by customers to higher capacity motorcycles and electric scooters.

In motorcycles, which account for 65% of total 2W sales, those with engine capacity of >110 cc but up to 125 cc have seen their share increase to ~27% in the current fiscal (April-Feb 2023) from 17% in fiscal 2018.

Hero Motocorp, which recently introduced its Xoom scooter, has also been the only company to have registered growth in a declining market. Against 260,111 motorcycles retailed in February 2022, it surged ahead with 327,402 units last month. Its highest sales in this category during the last six months was in September when it posted 390,785 units .

In the process, the combined domestic sales of other companies are not half of Hero’s during the last six months. “Hero has a huge advantage because of the number of dealerships in rural areas,” said Sengupta. This will be the biggest challenge for HMSI as it sets about plotting a roadmap for Shine 100.

“I do not see Hero's leadership in the segment going away anytime soon,” he explained. HMSI's 100 cc offering will hit the markets sometime in May and even with its aggressive pricing, opinions are still divided on its ability to wean away sales from the Hero Splendor.

Also Read

Honda To Establish E2W Component Ecosystem In Karnataka

Hero MotoCorp Joins USA-based Zero Motorcycles For Premium E2Ws